Editor’s note: The following is a press release from United Way of King County.

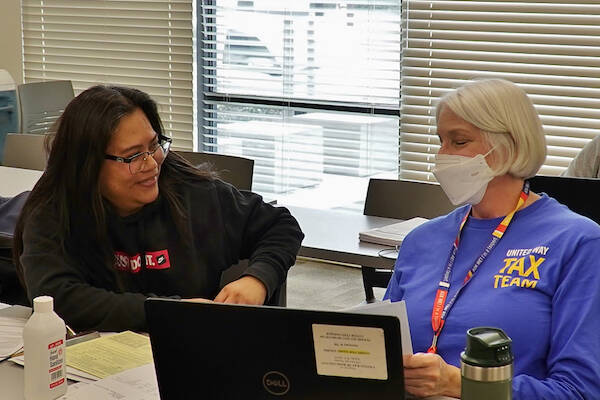

United Way of King County if offering free tax services from now through April 19.

The IRS-certified Volunteer Income Tax Assistance program has made the Enumclaw Library its workspace on Thursdays and Saturdays from 1 to 5 p.m.

The nonprofit asks filers to show up at least 45 minutes before close.

To receive tax assistance, bring: your spouse (if you’re filing jointly); a photo ID, social security card (or ITIN) for each person on your return (including dependents); W2s, 1099s, social security income documents and any other income-related paperwork; business expense documents (if self-employed); Form 1095-A (if you’re insured through the WA HealthPlan Marketplace), and a bank account and routing number.

Note that prior-year tax returns cannot be used to verify a social security number.

For more information, visit freetaxexperts.org.