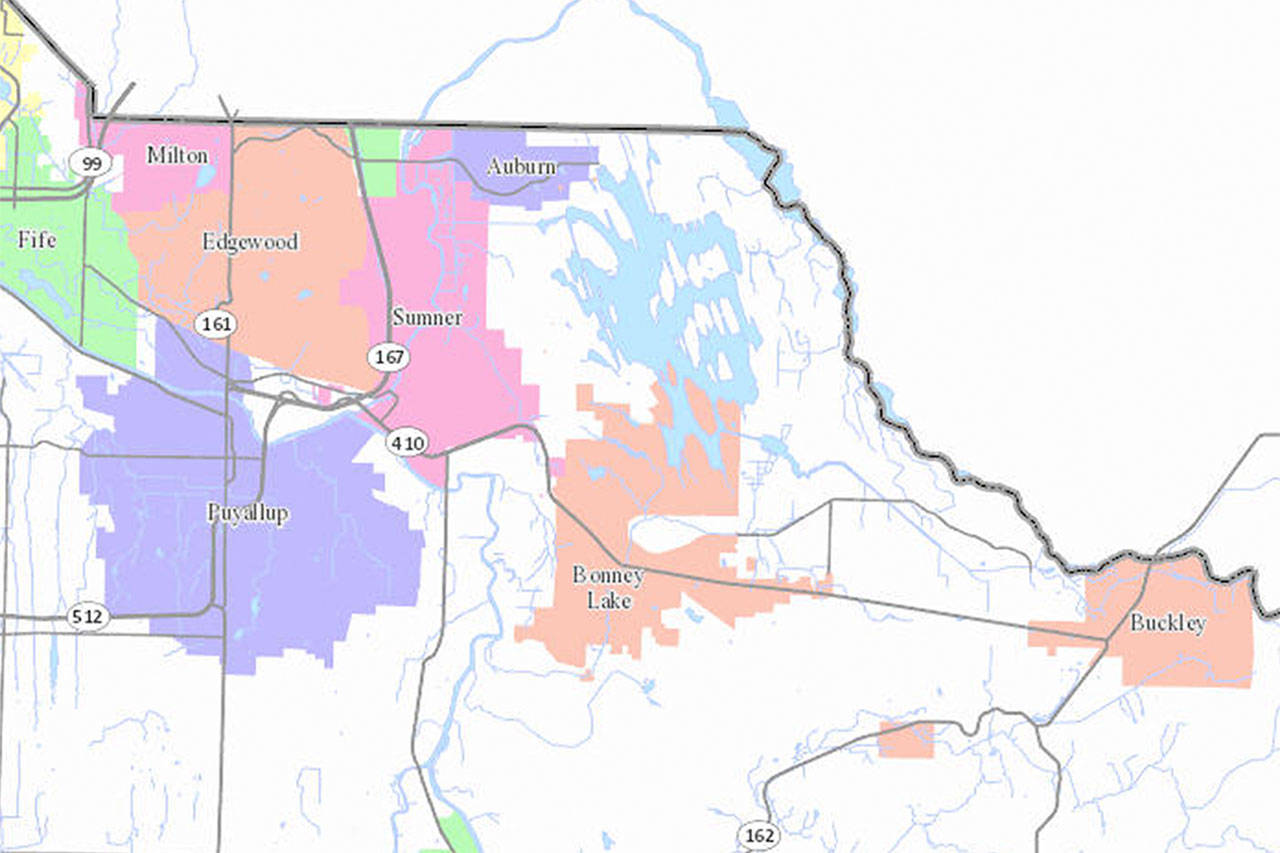

Property throughout Pierce County continues to increase in value, including those areas in and around Buckley.

That’s the result gleaned from the latest round of assessments done by the county assessor. That effort placed values on more than 327,000 individual parcels, with results either mailed or emailed last week to property owners.

The 2020 values will be reflected in the next round of tax statements, used as the basis for property taxes billed in February 2021.

“Homes in all parts of our county continue to increase in value,” said Mike Lonergan, Pierce County’s assessor-treasurer. Overall, he said, residential properties went up 8.8 percent this year, compared to a 7.5 percent jump in 2019, due to a continued strong real estate market.

Buckley was in the countywide ballpark, with the new average value for a single-family residence coming in at $350,818. That’s an increase of approximately 8.2 percent over last year. Nearby, the city of Bonney Lake’s average value is much higher at $421,141, but the annual increase was smaller (7.2 percent) from 2019.

Expanding Buckley’s borders a bit wider, taking in the entire White River School District, shows an average assessment of $384,947. That, too, is an increase of 8.2 percent over the previous year. In the small Carbonado school district, the average property value was pegged at $313,624, an increase of more than 8.8 percent.

Here’s a look at some surrounding Pierce County cities and towns. Included are the number of parcels assessed, the average property value for 2020 and the increase (by percentage) from 2019:

• Buckley: 1,570; $350,818; 8.226;

• Bonney Lake: 6,491; $421,141; 7.246;

• Wilkeson: 214; $229,814; 10.322;

• Carbonado: 225; $286,624; 9.636;

• Orting: 2,628; $323,290; 10.803;

• South Prairie: 118; $226,804; 7.981;

• Sumner: 2,472; $366,177; 6.653;

State law requires the assessor-treasurer to value properties as of Jan. 1, so the numbers released last week by Lonergan’s office do not reflect any change that may result from the COVID-19 pandemic.

“Actually, real estate sales have continued strong so far,” Lonergan said, “and if there is a softening of the market, that will begin to show up in next year’s assessed values.”

Lonergan cautioned homeowners not to jump to the conclusion that an increase in property value will result in a tax hike.

“It’s a math equation,” he said. “Your tax in 2021 will be the new 2020 value multiplied by the combined tax rates of your school district, city, fire district and so forth, added to the state and countywide property taxes that everyone pays.”

In the end, Lonergan said, much of the property tax bill is determined by “votes by the public and the Legislature.”

Countywide averages can be misleading, Lonergan added, because values change at varying rates in different communities. “The increase in Tacoma was slightly above the county average, bringing the typical Tacoma residence to $351,000, which is an increase of nearly $30,000,” he explained. “By contrast Roy’s increase was the lowest at 6 percent, for an average 2020 home value of $262,000.”

The highest average value in the county is $534,000 in Gig Harbor, up from $489,000 in 2019. The greatest percentage increase from year to year was 10.8 percent in Orting, for a new average value of $323,000.

One group of homeowners, scattered throughout much of the county, is seeing especially large percentage increases this year.

“Our depreciation tables were under-valuing most mobile homes by an average of 25 percent,” Lonergan said. “The demand for affordable housing has pushed resale prices for manufactured housing higher, and I am required by law to reflect that, so that everyone is taxed fairly.”

He added that any property owner who believes their property has been assessed unfairly may appeal to the Pierce County Board of Equalization at no cost. The appeal must be filed no later than Aug. 24, providing evidence that comparable properties have sold recently at a lower amount. More information is available at www.piercecountywa.gov/atr.