The Buckley City Council unanimously approved a measure proposing to lift the emergency medical services levy in the August general election during its April 9 meeting.

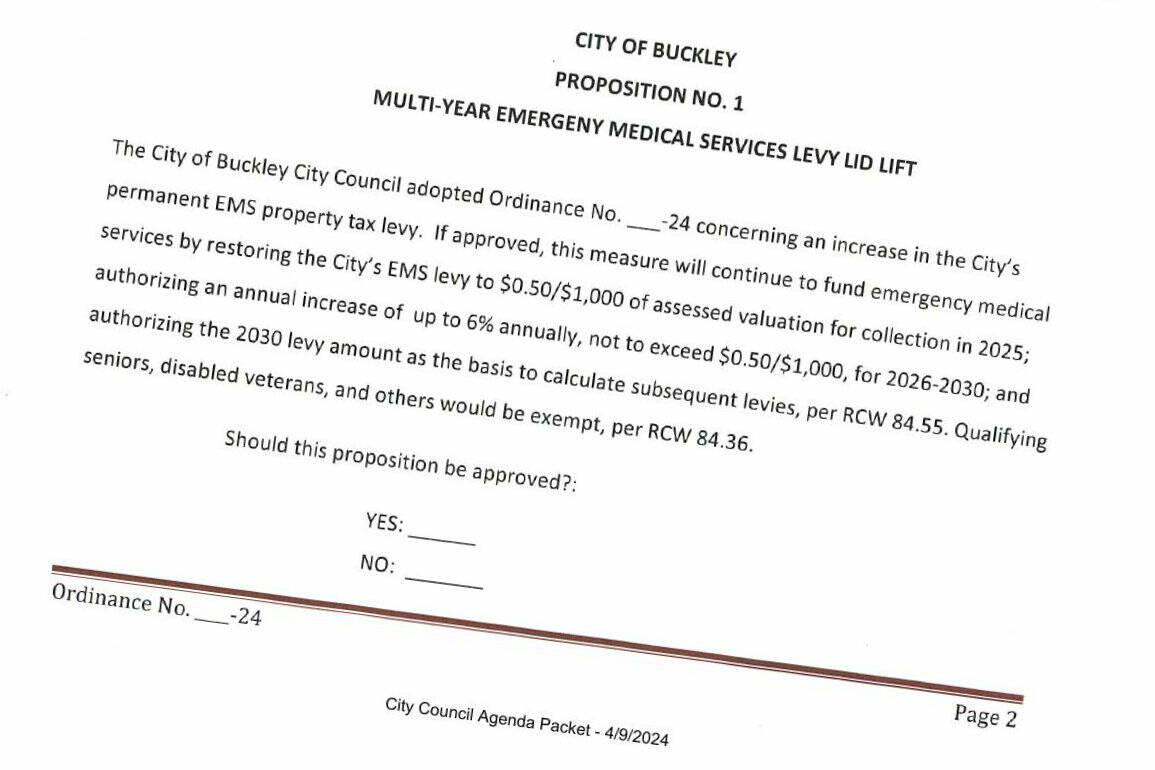

If 50% of voters approve the levy lid lift, the property tax would increase from roughly 30 cents to the maximum 50 cents allowed by state law.

The lid lift would be in place for six years, and each consecutive year, the city would be able to collect 6% more in property tax revenue than the previous year. Normally, municipalities and other entities like fire departments can only collect 1% more in revenue each consecutive year, unless a measure is approved by voters.

After 2030, the levy would revert to the 1% in additional collections, unless the city decides to run, and voters approve, another lid lift.

Talks about an EMS levy lid lift started during last year’s budget season, when the city was researching ways to mitigate expected shortfalls and deficits. While elected officials were split on many of the options available, it seemed everyone agreed that a lid lift was necessary to continue funding EMS service, with the added benefit of freeing up some general fund cash that has been subsidizing the fire department in recent years.

According to the city, the current 1% yearly collection increase is not sufficient for the department during a time when call volumes are increasing “rapidly”. According to the city’s 2024 budget, there’s been a 16% increase in calls since 2022 – more than four calls a day on average – and up to 90% of all fire department calls are for EMS.

At this time, the department is 90% staffed by volunteers, with just two full-time firefighters (plus an assistant chief and Fire Chief Eric Skogen).

DOLLARS AND CENTS

If voters approve this measure, the levy tax rate would be lifted from 30 cents to 50 cents per$1,000 in assessed property value.

For the average property owner with $500,000 in APV, this translates to a $100 increase in this property tax, from roughly $150 to $250.

But even though the city can collect up to 6% more in revenue each consecutive year until 2030, that tax burden is expected to lessen as APVs are expected to grow and development increases.

According to city projections, that could bring the tax rate down to 41.5 cents by 2030, if assessed valuation continues to grow by 10% every year.

If these projections are accurate, the fire department would see a a little less than $616,500 in 2025 collections, rising to about $825,000 in 2030.

WHAT WOULD YOU GET?

An increase in revenue would allow the Buckley Fire Department to hire an additional full-time firefighter, city staff has said.

According to the 2024 budget, doing so would mean a full-time firefighter “will greatly enhance our response capabilities,” as the fire station would then have one full-time firefighter seven days a week, all year long.

SENIORS AND DIABLED VETS

Elected officials expressed concern that such a property tax increase would unduly affect seniors and those with disabilities, including veterans.

Seniors and the disabled can apply for a tax exemption program through Pierce County.

Applicants must be 61 year old or older or disabled; have a maximum household income of $64,000 or less; and live in your primary home for at least six months of the year.

Depending on your income levels, you could be exempt from different levies and tax increases.

To apply, head to piercecountywa.gov/702/Senior-Citizens-Or-People-with-Disabilit.