Correction: A previous version of this article mistakenly switched the property tax increases and related statistics for Black Diamond and Enumclaw. The article has been corrected.

Plateau residents should have just received — or will shortly — their 2023 property tax statements from King and Pierce County.

ENUMCLAW/BLACK DIAMOND

King County expect to collect about $7.2 billion in property taxes this year, up from the $6.6 billion last year.

Overall, county single-family residence taxpayers saw the median property tax bills increase 13%, or about $798.

Enumclaw and Black Diamond residents saw similar double-digit median property tax bills increases.

Black Diamond registered a 12.2% increase in its residents’ median property tax bills, rising from about $4,720 in 2022 to $5,295.

But because median assessed property values rose more than $100,000 – from $512,000 to $661,000 – Enumclaw’s tax rate decreased about 13%, from about $9.22 per $1,000 in assessed property value last year to just over $8. This is because municipalities and other entities that collect property taxes can only collect 1% more in taxes than the previous year (or the amount of inflation, whichever is less).

To the south, Enucmlaw saw an 11.5% increase to its residents’ median tax bills, rising from $4,210 in 2022 to $4,695.

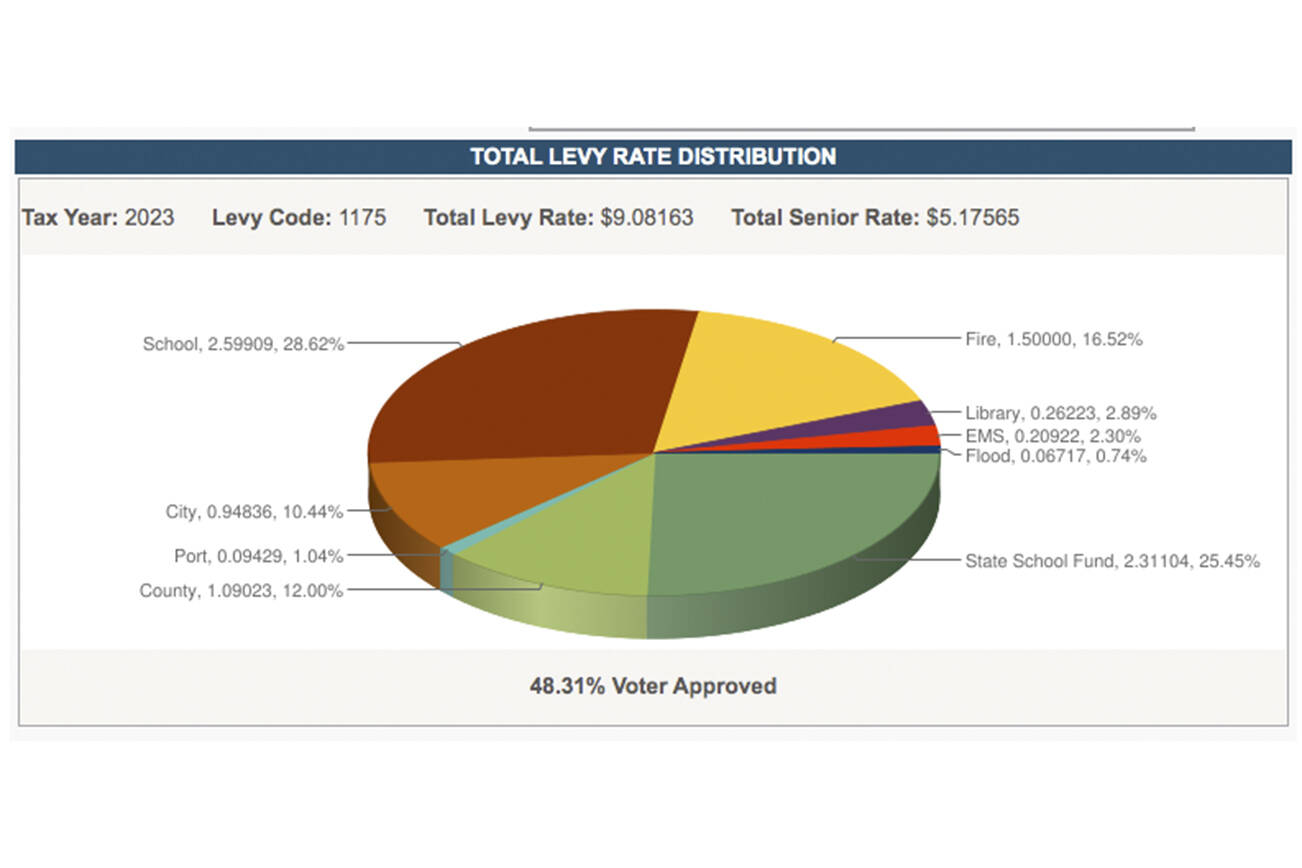

Median tax rates in the city dropped 9.4% – from just over $10 to about $9.08 – because the median assessed property value increased from $420,000 to $517,000, a 23.1% hike.

BUCKLEY/SOUTH PRAIRIE/CARBONADO

Countywide, property taxes increased by an average of 5.1% over the previous year for a total of $1.85 billion.

However, Buckley does not come even close to that sort of increase, as the average single-family home’s tax bill only increased about 1.4%.

According to the Assessor-Treasurer, assessed property values increased from an average of $435,165 in 2021 to $516,395 the following year.

Because entities that collect property taxes can only collect 1% more every year than the previous (or whatever the inflation percentage is, whichever is lowest), tax rates had to drop from $10.41 to about $8.90 to compensate.

The average Buckleyan’s tax bill increased about $63.53, from $4,531 in 2022 to $5,594 in 2023.

South Prairie’s tax rate, though, increased by 3.51%, from an average bill of $3,698 last year to $3,828 this year.

Finally, Carbonado skewed the average with its 8.66% tax bill increase, from $2,943 in 2022 to $3,198 this year. It was the highest tax bill increase in the county, city-wise — only the unincorporated Gig Harbor Peninsula area received a higher tax bill increase of $10,95.