The Enumclaw City Council recently passed an ordinance giving a temporary property tax exemption for certain multi-family developments within the city.

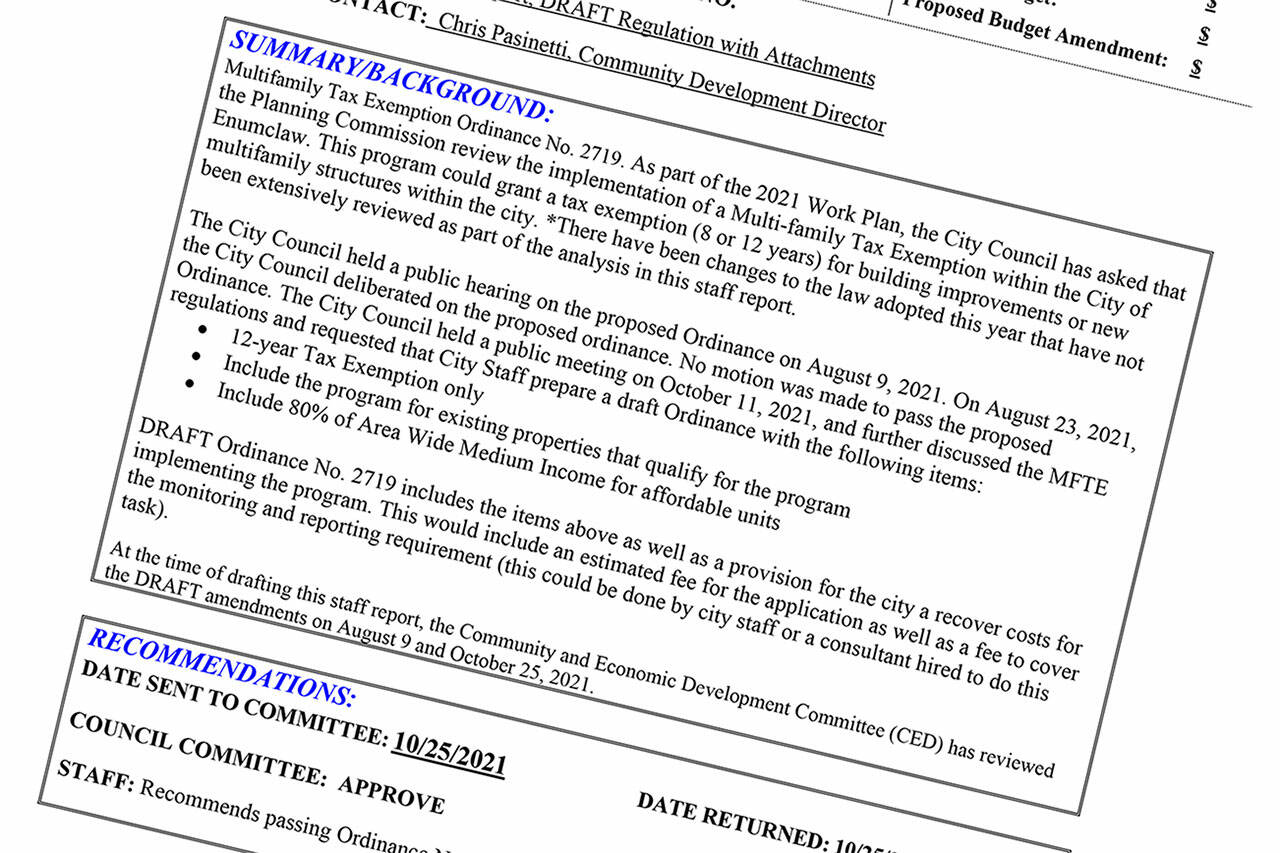

Ordinance 2719, which was approved during the Nov. 8 meeting, has been a long time coming; according to city Community Development Director Chris Pasinetti, discussion about the multi-family tax exemption (MFTE) started Feb. 8 of this year as part of the city’s Planning Commission/Community Development Work Plan.

In short, the MFTE will exempt multi-family developments — a.k.a. apartment complexes — from paying property taxes for 12 years if they meet certain criteria, namely that 20 percent of the dwelling units being constructed would be reserved for individuals or families that earn 80 percent or less of the area-wide median income for the county. The rent of those dwelling units would be adjusted depending on how much less of the median income is being earned.

According to the state Office of Financial Management, the projected 2020 median income for King County residents is $109,151.

The purpose of enacting an MFTE program is to “stimulate multifamily housing and does provide provisions for affordable housing units,” Pasinetti said in a Nov. 9 email to the Courier-Herald. “Very little market rate multifamily housing has been constructed within the city (excluding age restricted) in the last 30 years. This gives an incentive to develop under utilized multifamily zoned properties and requires a provision for affordable housing within those developments.”

Pasinetti also noted that there’s only one multi-family developments currently in progress in the city.

It’s unclear whether the city will face any financial repercussions to passing this ordinance, but it could affect how much tax other property owners pay.

“The amount of taxes that would normally be assessed are spread out among the rest of the properties,” Pasinetti said, adding that there are other factors regarding taxation and MTFE projects that could also come into play.

To that effect, the Enumclaw Fire Department Board of Commissioners voted unanimously to oppose the ordinance during its April 21 meeting.

“The tax exemption would result in property tax on the qualified project being transferred to the existing taxpayers, increasing their tax burden, which may have an adverse reaction to taxation which supports the Fire District as well as the other governmental services supported by property taxation,” reads a letter the board sent the Enumclaw council.

Additional opposition to the ordinance was noted by some members of the public during an Aug. 9 public hearing, as well as on social media; Council member Tom Sauvageau addressed those concerns during the Oct. 25 meeting.

“One of the larger public outcries on Facebook and social media about this is the idea that this is going to really open things up to low-income (housing),” Sauvageau said. “That’s just not true. Unfortunately, that misconception comes when people think that this is really targeted at that low-income group. What they don’t understand… (is) the current programs are open to federal tax exemptions that allow these builders to get these exemptions as long as they keep it at a 50-60 percent median income level.

“So what this is doing is actually increasing that amount, and helping us find to other options that aren’t as low of an income level that builders currently have right now,” he continued. “This gives us something else in our toolbox to use, and it’s not promoting low-income. It’s just giving us more options to look at, and if anything, it’s helping us to get away a little bit from that idea of low-income.”

SOLID WASTE RATE INCREASE

In other news, the Enumclaw city council approved an ordinance increasing the city’s solid waste rates.

“Leading up to the 2022 budget cycle… the city was informed that due to declining fund balances, King County Solid Waste Division will enact a rate adjustment of 9.4 percent for solid waste disposal. The per-ton charges for disposal of solid waste would increase from the current rate of $141/ton to $154.ton starting in January 2022,” the council agenda bill reads. “Additionally, both Waste Management Recycle and Cedar Grove Compost will enact a rate adjustment of 2.71 percent beginning December 2021 and 3.0 percent beginning January 2022, respectively.”

In response to the rising rates, the council approved a 7 percent local rate increase to cover these new costs during the Oct. 25 meeting; the rate increase “will result in an increase in cost to a typical residential customer (32-gallon waste toter with 96 gallon recycle toter and 96 gallon yard waste container) by $2.99 per month,” the bill continues, or about $36 a year.

A Public Works Department analysis of the rate increase stated the new rate will increase city revenue for solid waste services by just about $182,500 per year.