Editor’s note: A few numbers were incorrect in a previous version of this article. The bond measure going to the February 2023 ballot is for $253 million, not $243 million. Additionally, if the bond passes, the tax rate for the bond itself is $1.53, not $1.12, making the total estimated combined tax rate $4.19. This article has been updated.

Valentine’s Day is going to mean more than just romance next year — it may also mean the Enumclaw School District moves forward with its largest-ever overhaul, if the will of the voters makes it so.

The ESD Board of Directors unanimously approved moving forward with a $253 million bond to fund two new elementary schools, a new Birth-to-Five Center, a new high school performing arts center, a new sports and event stadium, and myriad other upgrades around the district, during its Nov. 21 meeting.

While the bond measure will appear on the Feb. 14, 2023 special election ballot, there are still some questions surrounding this massive undertaking, including final construction costs, tax rates, and building designs.

These unknown details are expected to be filled in after the bond is passed by voters, but there are some goals laid out by the district that voters can expect.

Beyond a new Byron Kibler Elementary and Birth-to-Five Center, planned to be built over the old J.J. Smith Elementary and pre-K facility, the district hopes to tackle various security, mechanical, electrical, plumbing, and structural repairs and upgrades at all other district buildings.

As for the performing arts center, the district is hoping for general modernization. Had board members gone for a less-expansive project, the district was planning on repairing or upgrading the current auditorium’s roofing and siding, the mechanical, electrical, and plumbing systems, and making some “basic” audio-visual and stage upgrades.

Finally, ESD is aiming for the new sports stadium to have seating capacity for not just sports, but graduation as well; have it be located on district property; improved ADA accessibility; locker rooms for athletes; and have the stadium be rented out for additional district revenue.

TAX RATE ESTIMATE DROPS

The Courier-Herald erroneously reported in early November that ESD’s tax rate for the bond dropped from previous estimates.

This time, it’s for real.

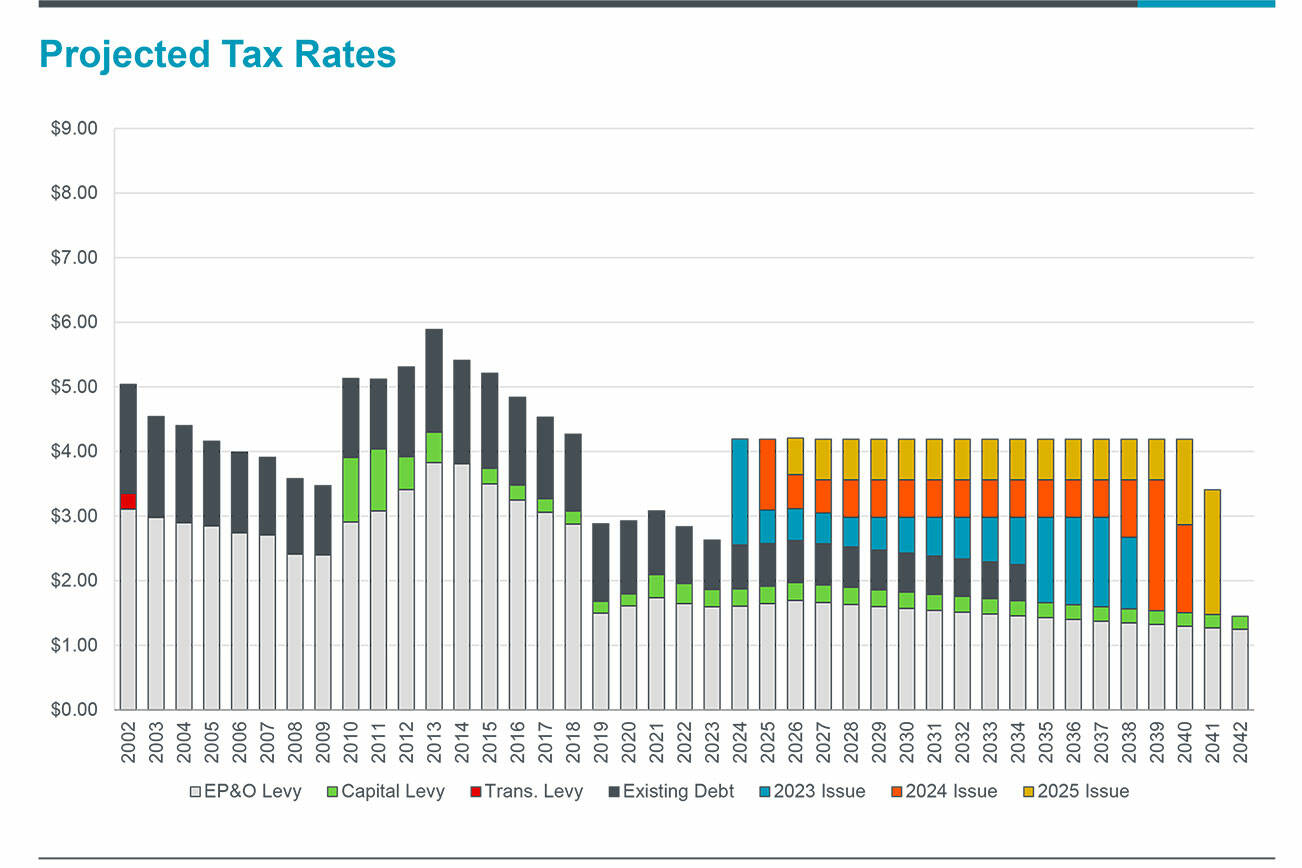

Trevor Carlson from Piper Sandler, an investment banking company, told the school board that the new combined tax rate estimate for a $253 million bond is $4.19 per $1,000 in assessed value. This would go into effect in 2024, if voters approve the bond.

The combined tax rate includes an Educational Programs and Operations (EP&O) levy, a tech levy, and what remains of the last bond passed by voters in 2015.

The previous combined tax rate estimate was $4.67.

This means if the bond measure is approved, a homeowner with $420,000 in property can expect the district’s portion of their annual tax bill to come out to just about $1,760 (the previous estimate was about $200 more) — and that doesn’t take into account other property taxes and levies that go to other entities, such as the cities of Enumclaw or Black Diamond, King County, libraries, fire departments, etc.

Carlson added that the combined tax rate of $4.19 could stay steady, or potentially decrease, through 2040.

A HISTORICAL PERSPECTIVE

At the end of the day, the final cost, tax rate, and designs will need to prove popular enough to garner not 50%, but 60% local approval, and at least 40% of the number of ballots cast in the previous election (which was the November general election) need to be submitted for this election for the measure to pass.

This could prove difficult.

Out of the 11 bonds ESD has put out to its voters over the last three decades, only three were approved — one in 1988 for $7.5 million (nearly 72% approval); another in 1997 for $31 million (just over 61%); and the third, passed in 2015, was a $68.5 million bond measure that only passed with four votes.

Voters may also recall that the last bond passed did not adequately fund a new performing arts center for the high school, one of the bond’s large selling points. The district is aiming to be more transparent and careful with the numbers being presented to them (it said at the time the board of directors were given bad information early in the planning process) but trust in the district could be a factor in whether the bond is approved.

Other districts around Washington have also found it hard to convince voters to approve their bonds, which ranged from $5.2 million to $676 million; out of the 19 districts that ran bonds this year, only four passed. However, three districts (Northshore for $425 million, Highline for $518 million, and Renton for $676 million) were located in King County.