Local voters will soon have the opportunity to decide the fate of more than $52 million in school district funding in the upcoming special election.

The Enumclaw School District’s Board of Directors passed a resolution to put a replacement Educational Programs and Operations (EP&O) levy measure on the Feb. 8, 2022 ballot during its regularly-scheduled Nov. 22 meeting.

According to the district, the school district receives “insufficient” funding from the state under the 2017 Basic Education Funding Act, necessitating an additional levy.

“The EP&O levy funding is needed to pay for eligible educational programs and operations not fully funded by the state’s prototypical funding model, including counselors, nurses and health room professionals, safety and security, custodians, librarians, para-educators, certificated staff, early learning services, special education services, transportation, social and mental health services, fine arts, athletics, co-curricular programs and the maintenance of playgrounds, playfields, and other facilities,” district Public Information Officer Jessica McCartney wrote in an email.

Residents living within the school district’s boundaries first passed an EP&O levy during the February 2018 special election; the measure passed with 56.6 percent approval, although it should be noted only around a third of registered voters in the area cast a vote on the measure.

Voters also approved a technology levy for the district during the February 2020 special election, passing with about 56 percent approval (again, only about a third of registered voters cast a vote).

The EP&O levy is different than the tech levy: “The EP&O levy funds the above-mentioned services, whereas the Technology Levy funds are specifically used for instructional technology for students,” McCartney continued. “Examples include access to Chromebooks/devices and increased connectivity for students.”

DOLLARS AND CENTS

Here’s how your wallet could be affected, if the 2022 EP&O levy is passed by local voters.

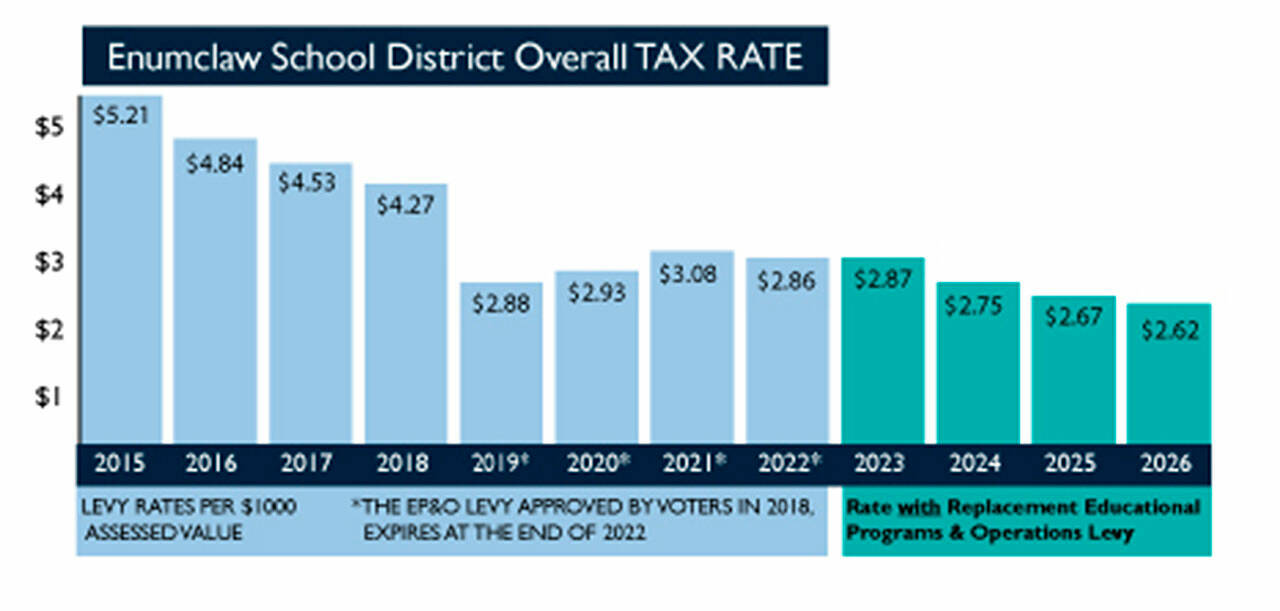

Before we get into the numbers, though, readers should note that the EP&O levy is only a portion of the ESD overall tax rate, which also includes the aforementioned tech levy and the residual effects of the 2015-approved bond that went toward renovating the high school and construct a new Black Diamond elementary school.

The second note of interest is that while the estimated tax rate for residents decreases over the years, the annual uptick in property values results in increasing collections for the school district.

Alone, the replacement EP&O will account for $1.77 of the overall tax rate per $1,000 in assessed property value in 2023; $1.71 in 2024, $1.67 in 2025; and finally, $1.65 in 2026.

The overall tax rate in 2023 is expected to be $2.87 per $1,000 in assessed value; for a homeowner with property valued at $500,000, this would mean paying about $1,435 in taxes that year.

In 2024, the overall tax rate is estimated to be $2.75 per $1,000 in assessed value; homeowners with a $500,000 home would pay about $1,375 in taxes.

The overall tax rate in 2025 is expected to be $2.67 per $1,000 in assessed value, meaning those with property valued at $500,000 would pay about $1,335.

Finally, the overall tax rate in 2026 will be around $2.62 per $1,000 in assessed value; again, for those with property values at $500,000, this would mean paying about $1,310 in taxes.

All together, the overall levy rate will provide the school district with around $13.6 million in 2023; $14.6 million in 2024; $15.7 in 2025; and $16.8 million in 2026, for a grand total of around $61 million over the next four years.