The Enumclaw School District is once again turning to voters to renew funding with a proposed capital projects levy.

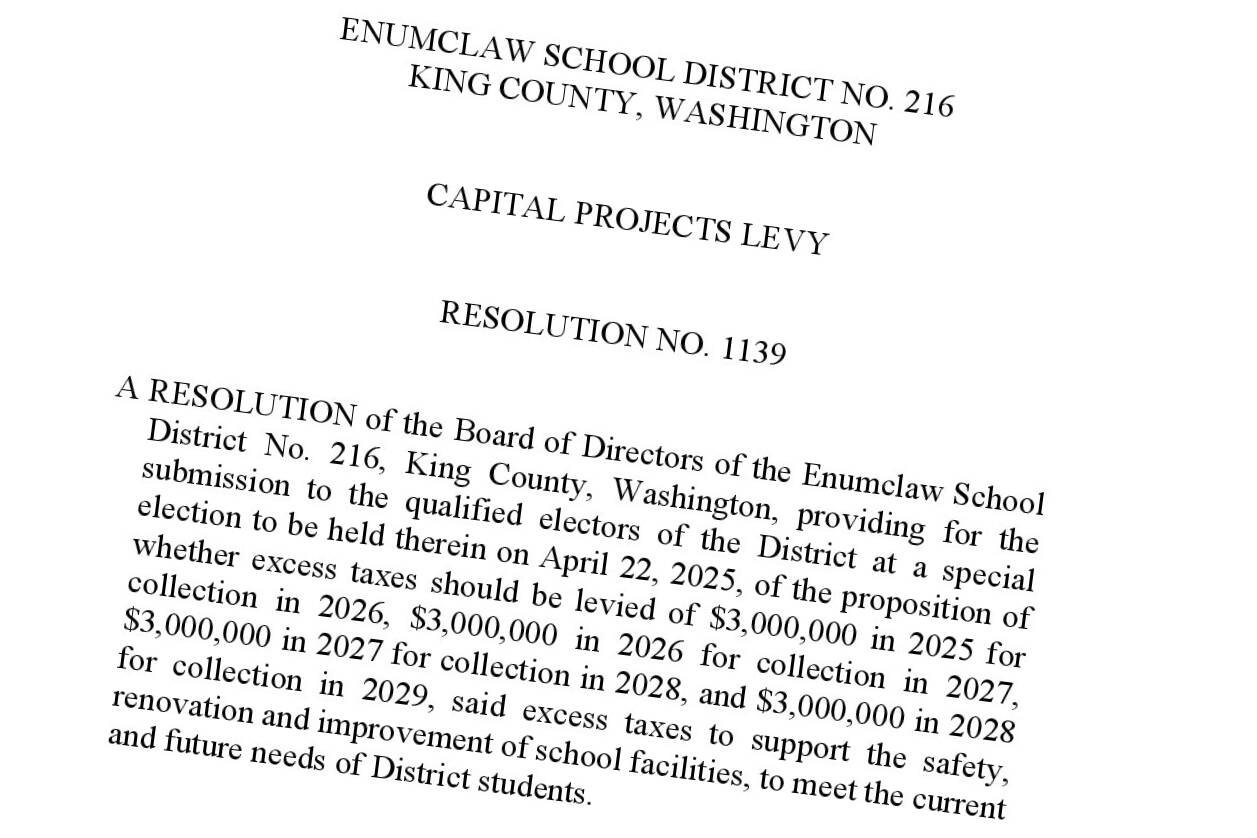

The ESD Board of Directors approved the levy measure for the April special election during their Feb. 10 meeting, with officials commenting that “there is no other option to accomplish these important repairs,” according to meeting minutes.

Although the bond measures put to voters during the February and November 2023 elections were heavily focused on building new schools, a portion of the bond was also earmarked for upgrades and repairs around the district.

After the bonds failed, the district formed a Facilities Oversight for Capital Utilization and Sustainability (FOCUS) Committee made up of members of the public. The group’s task was to determine the district’s needs two decades from now, and how to meet those needs.

A not insignificant portion of the committee’s final recommendations to ESD focused on deferred repairs and maintenance as well as a lack of modern security measures and the cost of retrofitting the facilities. As a result, it recommended the district put a levy proposal to voters to address critical needs before following up with a bond in the future for larger projects.

Levies need a simple majority (50%) of votes to pass.

DOLLARS AND CENTS

An exact levy tax rate is not yet set, but the district estimates that if voters approve the levy during the April special election, an additional 37 cents per $1,000 in assessed property value will be added to residents’ tax bill.

For homeowners with $500,000 in APV, this comes out to $185 a year.

However, the maximum collection every year through 2029 is $3 million, so as the district’s population grows and housing values rise, the tax rate will depreciate. The district estimates it will drop to 33 cents in 2029.

ESD’s 2024 total property tax rate is just over $2.91; it has depreciated this year, according to the district, but an exact rate has not yet been determined.

Factoring that in, however, means it’s likely approving the capital levy would raise the total tax rate to around $3.20 to $3.28.

Again, for a homeowner with $500,000 in APV, the total annual tax bill could increase by $200.

If 2024 tax rates hold similar to this year, the increased rate would puts ESD’s tax rate above neighboring Kent School District ($2.96), but it would likely remain below the White River ($3.72), Tahoma ($3.82), Sumner/Bonney Lake ($3.94), and Auburn ($4.70) school districts’ tax rates.

PROPOSED PROJECTS

According to the levy resolution, the district plans to use this tax revenue to upgrade electronic access security and alarm systems at school buildings; replace HVAC systems and kitchen equipment across the district; repair or replace roofing; install energy-efficient lighting; replace boilers, pumps, and water heaters; upgrade radios; and install GPS equipment in school buses.

Additional information about these projects will be discussed if the levy measure is approved by voters.

LEVY HISTORY

While locals look very unfavorably on the 2023 bond measures, voters have supported numerous new and renewed levies since 1998.

In more recent years, residents passed capital project levies in 2009, 2014, and 2020, with an average of 55% approval.