Insurance rates have been on the rise, but some local agents are seeing a light at the end of the tunnel.

If you’ve been paying attention to your rates, you may have seen some double-digit increases these past few years after a period of little-to-no bumps; this is the result of what insurance agents like American Heritage’s Mike Runland and Babbit Insurance owner David Babbit call a “hard market.”

“We’re seeing anywhere from 20, 30%, up to 100% increases in policies,” Runland said in a recent interview.

A hard market, the two said, is when insurance companies clam up; due to various factors, many are now operating at a loss — Babbit, who sits on the Professional Insurance Agents Western Alliance’s Pacific Northwest Services Corporation board of directors, said that the current market average is that for every dollar they take in, they’re having to spend $1.30.

“They’re having to pay out a lot of money in claims,” Babbit said, so as a result, insurance companies are “walk[ing] away from business” by being more restrictive with their policy packages, declining to take on new customers, and increasing rates.

This is happening across many markets, the two said.

Auto insurance appears to have been hit the worst in Washington; according to Washington state Office of the Insurance Commissioner Communications Manager Aaron VanTuyl, the average annual policy increase in 2023 was nearly 25%, and this year, from January to June, the average is close to 14%.

This was after a five-year period where the average annual increase never exceeded 3%, and even decreased by 3% in 2020.

That decrease is attributed to the beginning of COVID-19 pandemic, when a lot of people stopped driving. However, factors like the high-demand, low-supply market; the fact that cars are becoming more complex, increasing the price of vehicles and the parts they use; and long repair turnaround contribute to higher auto insurance rates.

Additionally, while the number of auto crash and accident claims haven’t substantially risen, VanTuyl said the number of severe crashes has increased; the news publication Stateline reported last November that there was an 18% increase in traffic deaths between 2019 and 2022, another factor in rising auto insurance rates.

It’s the same story for homeowners insurance and health insurance — homeowners insurance increased an average of 16% in 2023, and another 12% this year so far.

Runland said a major issue with rising homeowners insurance is the increase in catastrophic losses; for example, the Insurance Information Institute reports the total insured property loss in natural disasters between 2021 and 2023 was upwards of $300 billion, a 37% increase from the $218 billion reported in the previous three years.

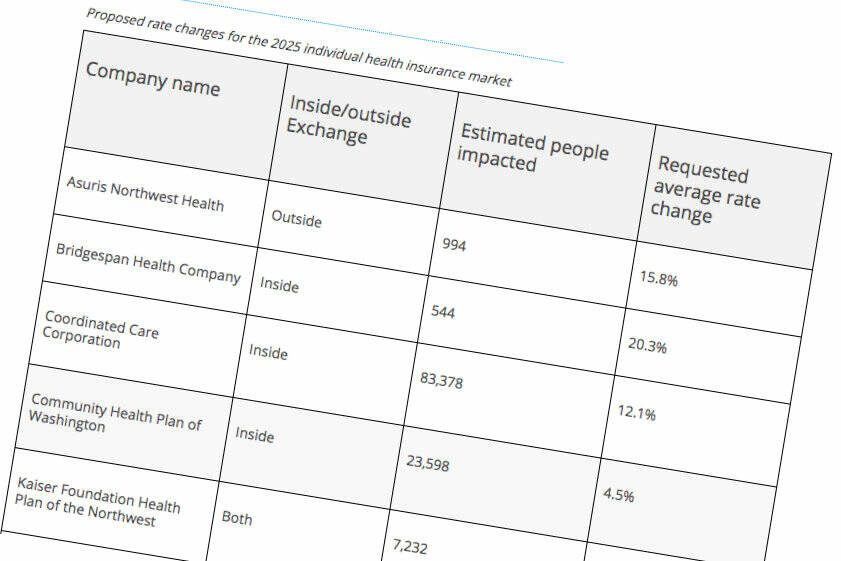

Finally, health insurance rates rose 7% in 2023, another 9% in 2024, and the average requested change for 2025 is just over 11%; according to Roundstone Insurance, medical inflation, an aging population, and technological advances that have increased the cost of tests and procedures, have contributed to increasing rates.

“All this stuff snowballed at once,” Runland said, adding that as a local insurance agent, he personally sees how his Plateau customers are being negatively affected.

It’s the same over at Babbit Insurance; Babbit said that his team takes a look at their clients’ insurance rates every day and flag those that increased 5% or more and determine the factors behind that jump and how to address them.

In the past, his team only had to examine a few claims per day — but now they’re handling dozens, he continued, forcing his customers to think about getting higher deductibles, taking a vehicle off collision insurance and put it on comprehensive insurance, or even not filing small claims just in case a big one comes in, all to reduce their rates.

“We’re having those conversations quite a bit,” Babbit said.

Additionally, they’re now inundated with new clients calling in because they can’t connect with the larger insurance companies.

And those that do, Runland said, are practically automatically declining to take on new clients if they don’t have a clean record — no claims for the last five years.

“This is the worst I’ve ever seen it,” he continued. “It’s frustrating, because a lot of times, it’s a claim that’s out of your control.”

However, both Babbit and Runland said they hope to see insurance rates plateau in the next year — not to decrease, but to get back to smaller increases year-to-year.