The numbers are in, and the assessed property values of the Plateau – on the King County side – have increased.

The King County Department of Assessments announced the new assessed property values (APV) in various press releases on July 11.

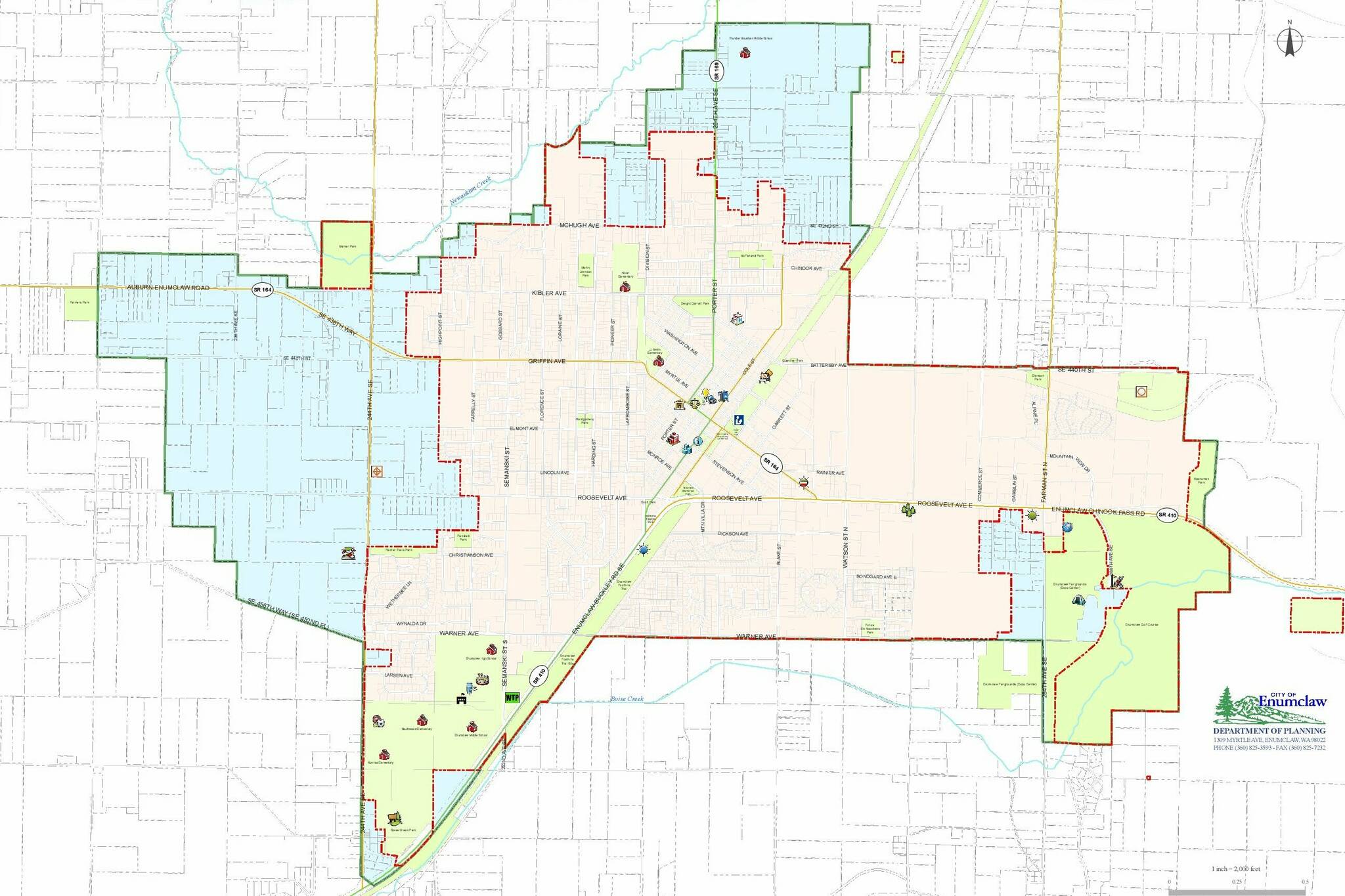

APVs rose across King County, but assessed property values for single-family homes and similar property inside Enumclaw appears to have risen more than average by 16.6% over the previous year, from a median of $477,000 to nearly $556,000.

And the unincorporated area around Enumclaw saw a similar rise for single-family homes, from a median assessed property value of $744,000 to $857,500, a 15.5% increase, over 2023.

Finally, Black Diamond’s assessed property values for single-family homes in this area grew 10%, from $724,000 to $797,000.

The Department of Assessments said it’s still too early to calculate the overall medial single-family property assessed value increase, but it’s been estimated to be in the double digits around 10% at this time.

What this means for next year’s property taxes is unclear.

Because the county can only collect 1% more in property taxes year-to-year, as assessed property values increase, the property tax rate has to decrease to compensate.

But King County passed levies in the past year, which will increase property tax levies.

As for market values of homes in the area, Enumclaw’s median sale price was $972,000 last year, Black Diamond saw a median sales price of $861,500, and unincorporated King County a median price of $625,600.