April 24 update:

Enumclaw School District Prop No. 1:

Yes: 45.39%

No: 54.61%

Ballots counted: 6,929

Voter participation: 30.92%

***

April 23 update:

Enumclaw School District Prop No. 1:

Yes: 44.88%

No: 55.12%

Ballots counted: 7,845

Voter participation: 35.01%

***

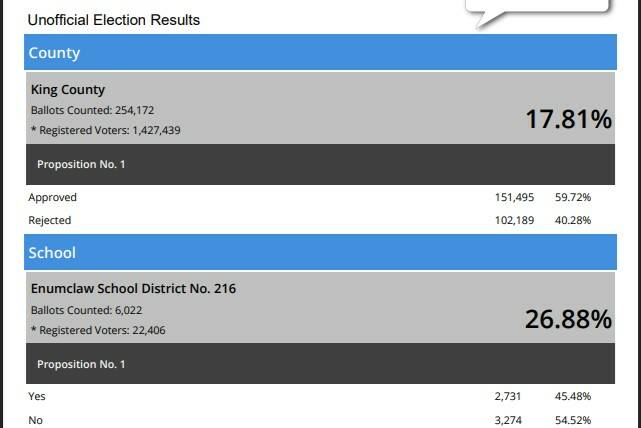

Original story: Results are in, and the Enumclaw School District levy is being rejected by voters.

At this time, more than than 54% of the roughly 6,000 votes counted on election night declined a proposition to fund what ESD called “critical maintenance” across the district.

The King County fingerprint ID program levy was passing with close to 60% of the vote.

ESD LEVY

Unless supporters of ESD’s critical maintenance levy can overtake a 543-vote election night lead and stay ahead as more votes get counted through May 2, the proposition to fund various maintenance projects across the county will be rejected.

What was proposed was a property tax rate of 37 cents per $1,000 in assessed property value to address 32 various repair and upgrade projects around the district, which include replacing roofs, HVAC systems, fire panels, electronic access, and water heaters.

A full list of projects can be found at enumclaw.wednet.edu/page/critical-maintenance-levy-2025.

For the average property owner with $600,000 in APV, that calculates out to $18.50 a month, or $222 a year.

However, the tax rate is expected to decrease over the lifespan of the levy because revenue collection is capped at $3 million per year. That means when assessed property values increase, or more taxpayers move into the area, the tax rate has to decrease to compensate.

The tax rate could decrease to 33 cents in 2029, according to the district, though that number is not set in stone and calculating how that will affect annual tax bills is difficult, as assessed property value could also change between now and then.

But initially, when you add the new levy to the total property taxes the district collects, the total tax rate rises from $2.71 to $3.08 per $1,000 in APV. Annually, that’s an increase from $1,628 to $1,848.

FINGERPRINT ID LEVY

The Regional Automated Fingerprint Identification System (AFIS) Levy, known as Proposition No. 1, funds the continued operation of the AFIS system to provide enhanced forensic fingerprint and palmprint technology along with services to aid in the administration of justice.

The levy will authorize an additional property tax for seven years, beginning in 2026, at 2.75 cents per $1,000 APV. This is down from the 2018 AFIS levy, which adopted a rate of 3.5 cents.

For a homeowner with $600,000 in assessed property value, that’s an additional $16.50 added to their annual tax bill.

According to the ordinance, King County voters first approved the funding of an AFIS computer in 1986 to match unknown fingerprints to known fingerprints.

The King County AFIS database now holds more than two million fingerprint records, more than one million palm print records, and approximately 63,000 crime scene prints from unsolved records; all this information is available to every city in the county.

The program helps law enforcement search for possible suspects from evidence collected at crime scenes and identify people using aliases.

The first AFIS computer was installed in 1988. Three decades later, the information has been upgraded to a cloud-based system.